Winning large government contracts is a complex and highly competitive process. Success often depends not just on having the right solution but on understanding the environment, the stakeholders, and the competition. At its core, competitive intelligence transforms raw information into actionable insights, allowing organisations to anticipate customer needs, outmanoeuvre rivals, and position themselves as the obvious choice. This process is part science, part strategy, and essential in today’s procurement landscape.

Competitive intelligence begins with ethical, resourceful analysis. It’s not about espionage or unethical practices but about gathering and interpreting readily available information—industry presentations, public filings, social media posts, and even speeches by competitor executives. The team at Enable once successfully anticipated a competitor’s strategy by analysing a years-old YouTube video of a speech given by their CEO. What seemed, on the surface, to be a general industry overview revealed critical insights into their investment priorities and strategic goals. By analysing the CEO’s language and behaviour, Enable identified key drivers in their personality that could be exploited in a ghosting strategy—subtly aligning messaging and proposals to highlight gaps in the competitor’s capabilities without directly naming them. This nuanced approach gave Enable’s client a clear advantage in the bidding process.

Competitive Analysis is a process, not an off-the-shelf report

This level of insight underscores the value of competitive intelligence as an ongoing process, not a one-off exercise. Practical intelligence demands creativity in sourcing information and discipline in analysing it. For instance, seemingly unimportant details like patent filings or job postings can hint at a competitor’s plans. A sudden surge in hiring for a specific skill set might indicate an upcoming investment in a new capability. In the hands of experienced analysts, these details become part of a larger picture, allowing businesses to predict and outmanoeuvre competitors before proposals are even drafted.

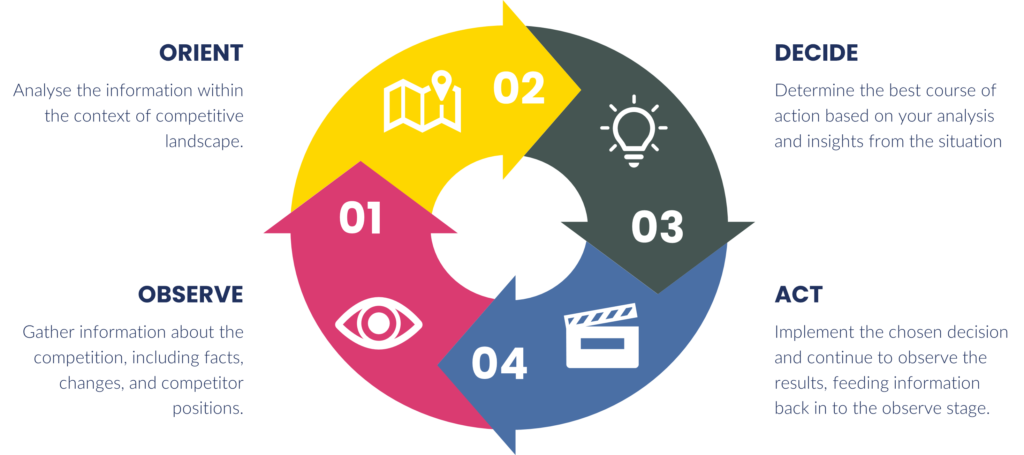

Frameworks such as the Observe-Orient-Decide-Act (OODA) model are essential in turning raw data into actionable strategies. Observe involves identifying observable facts—what the competitor is doing or saying. Orient is where these observations are analysed: Why is the competitor pursuing a particular course of action? What is their underlying goal? Decide translates these insights into strategic actions. If a competitor invests heavily in a specific technology, your response might be to highlight your organisation’s superior performance in a different, more relevant area. Act does what it says on the tin – take action and feed new information back into the Observe phase.

High-stakes capture needs more than Marketing 101

When pursuing contracts worth billions, your approach to competitive intelligence must reflect the complexity and unpredictability of modern markets. While foundational, the old standard Five Forces framework operates on assumptions that no longer hold in today’s dynamic environment. Industries are no longer isolated entities with predictable players; they are ecosystems shaped by technology, globalisation, and evolving societal pressures. Competitors don’t just introduce rival products—they redefine industries through disruptive innovation. Customers don’t just demand better prices—they seek alignment with values like sustainability, social responsibility, and technological advancement. A Five Forces analysis provides a snapshot of competition but cannot account for the interconnected forces that drive long-term success. A Ten Forces framework integrates these overlooked dimensions, capturing the regulatory shifts, environmental pressures, and digital disruptions often deciding the winners and losers in complex procurements.

Consider the forces at play when competing for a high-stakes government contract. Beyond understanding supplier power or potential substitutes, success depends on anticipating how global supply chains react to geopolitical tensions or how rapidly evolving customer expectations redefine what constitutes value. Competitor strategies are increasingly shaped by leadership dynamics, partnerships, and technology investments—factors invisible in traditional analysis. For example, analysing the behaviour and language of rival executives can uncover their strategic priorities, allowing you to subtly ghost their weaknesses in your proposal without ever naming them. Similarly, understanding a client’s public commitment to environmental goals or digital transformation allows you to position your offering as the solution to their future needs, not just their current requirements. Competitive intelligence built on Ten Forces goes beyond describing the market—it provides the foresight and agility to shape it, ensuring that your organisation isn’t just a contender but the preferred choice in the eyes of decision-makers.

Understanding the people driving competitor strategy

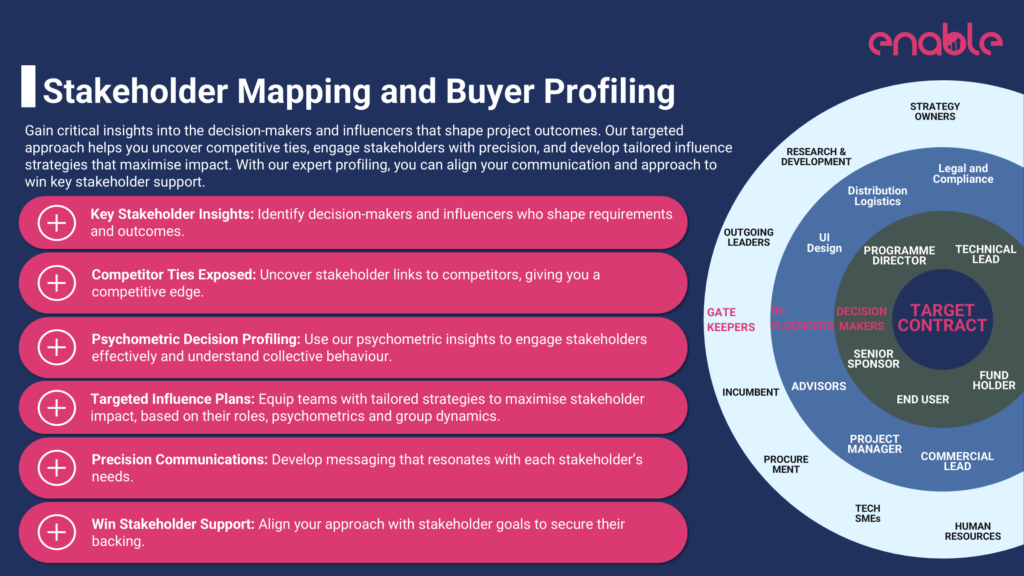

Drawing out a stakeholder map may provide a surface-level understanding of who holds influence. Still, it is insufficient when crafting a nuanced win strategy for a billion-pound contract against intense competition. To secure such high-stakes deals, organisations must delve deeper into the psychological and behavioural drivers that inform stakeholder decisions. Psychometrics allow for the profiling of decision-makers, uncovering how they process information, what motivates them, and how they prefer to engage. Background checks provide critical context—such as career history, personal priorities, and connections to competitors—illuminating the dynamics behind their influence.

Insights into customer priorities play an equally vital role. Large government contracts are not awarded based on capability alone. Decision-making committees often consist of stakeholders with varying financial, technical, or operational concerns. Competitive intelligence helps tailor proposals to address these diverse perspectives, ensuring the bid resonates across all decision-making levels. By understanding what different buyer types prioritise, a proposal can be crafted to speak directly to each stakeholder’s needs, from cost savings to usability and compliance.

For instance, financial stakeholders might focus on the overall return on investment, seeking evidence that your solution will deliver immediate and long-term savings. Technical stakeholders may prioritise integration with existing systems or the ability to meet stringent compliance standards. End users, meanwhile, are concerned with practicality and ease of use. A proposal that addresses these varied needs simultaneously is far more likely to succeed. Enable’s focus on mapping customer priorities ensures that proposals are well-crafted and directly aligned with what matters most to the decision-makers.

Competitor Analysis helps you stand out from the crowd

These insights feed directly into the capture planning process. Capture planning is the disciplined approach to influencing customer preferences before formal procurement begins. By focusing on iterative steps like stakeholder engagement, strategic alignment, and continuous validation, organisations can ensure they are not just responding to a tender but shaping it. A well-executed capture plan increases win-rates while reducing the required bids, saving both time and resources. Enable’s expertise in this area is a cornerstone of their approach, helping clients move from an unknown position to becoming the preferred choice.

Stakeholder engagement is one of the most potent elements of capture planning. Building relationships with key decision-makers early on allows you to shape their understanding of your organisation’s strengths. These relationships often reveal unstated needs or concerns, enabling you to craft a proposal that addresses issues your competitors might overlook. When done well, this proactive approach positions your organisation as a trusted advisor rather than just another bidder.

Enable’s process doesn’t stop at engaging stakeholders. Strategic alignment ensures that every aspect of the bid resonates with the customer’s broader objectives. For example, if the customer has publicised a commitment to sustainability, Enable helps clients position their proposals to highlight environmental benefits. This alignment demonstrates an understanding of the customer’s priorities and a shared commitment to achieving them.

Continuous validation is another crucial component of effective capture planning. Markets and customer needs can shift quickly, especially in large, complex procurements. Enable ensures that strategies remain adaptable, allowing clients to refine their approach in response to new information. This iterative process keeps bids relevant and competitive throughout the procurement cycle.

Enable Strategic Consulting excels in turning these principles into practice. Whether facilitating win strategy workshops, conducting stakeholder mapping, or delivering price-to-win analysis, Enable combines competitive intelligence with capture expertise to create a clear path to success. Clients consistently report increased win rates and improved competitive positioning when these methods are applied effectively. This isn’t just theory—it’s proven, repeatable success. With Enable, clients not only meet their immediate objectives but also build the frameworks and strategies to sustain success over the long term.

We Enable Capture

Securing your next large contract requires more than technical capabilities or a strong proposal. It demands a deeper understanding of the competitive landscape, the motivations of decision-makers, and your rivals’ strategies. With Enable Strategic Consulting, you gain a partner who understands these dynamics and how to turn them into actionable strategies that deliver results. Now is the time to take your bidding approach to the next level. Position yourself to win. Start your journey with Enable Strategic Consulting today.